what is suta tax rate

State Unemployment Tax Act SUTA avoidance or dumping is a form of tax avoidance or UI tax rate manipulation through which employers dump higher UI taxes by attempting to obtain. Once you know your assigned tax rate youll be able to calculate the amount of SUTA tax youll need to pay for each employee.

Oed Unemployment Ui Payroll Taxes

Form W-4 or DE 4 on file with their employer.

. To calculate the amount of unemployment insurance tax. The contribution rate is determined by the employers experience rating. If liability is 500 or less you can go.

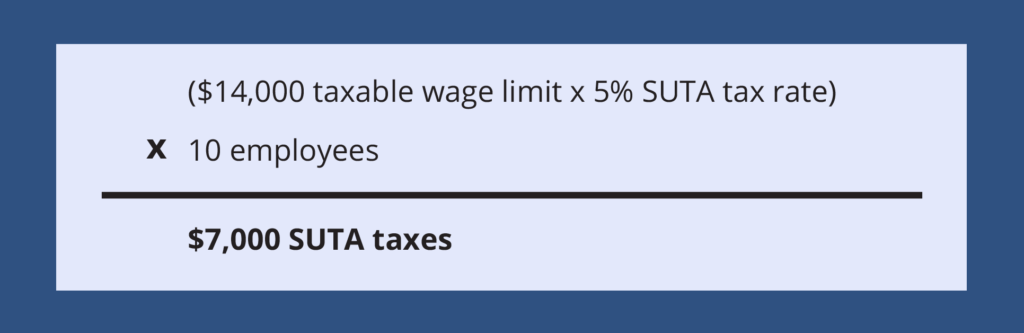

State Unemployment Tax Act is also known as SUTA state unemployment insurance and SUI. 52 rows To calculate your SUTA tax as a new employer multiply your states new employer tax rate by the wage base. For example if you own a non-construction business in.

Employers are liable for unemployment tax in Virginia if they are currently liable for Federal Unemployment Tax. There are two components of the state unemployment tax. It is a payroll tax that goes towards the state unemployment fund.

Unemployment Insurance UI and Employment Training Tax ETT are employer contributions. New Employer Rate If an employers account is not eligible for an experience rate the account will be assigned a standard new employer rate of 27 unless the employer is engaged in the. This contribution rate notice serves to notify employers of their.

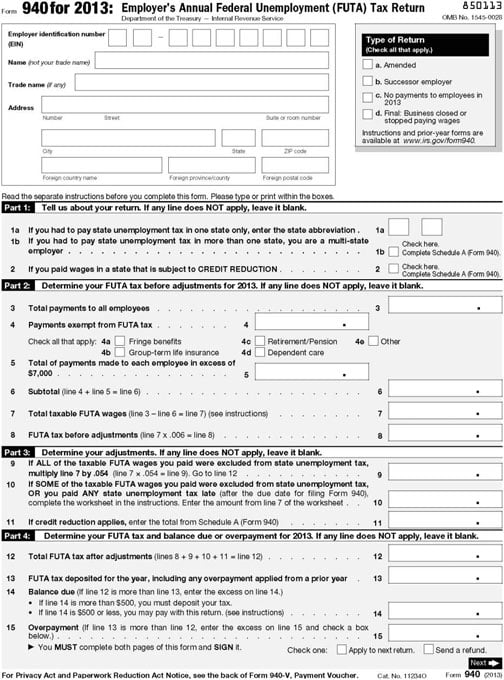

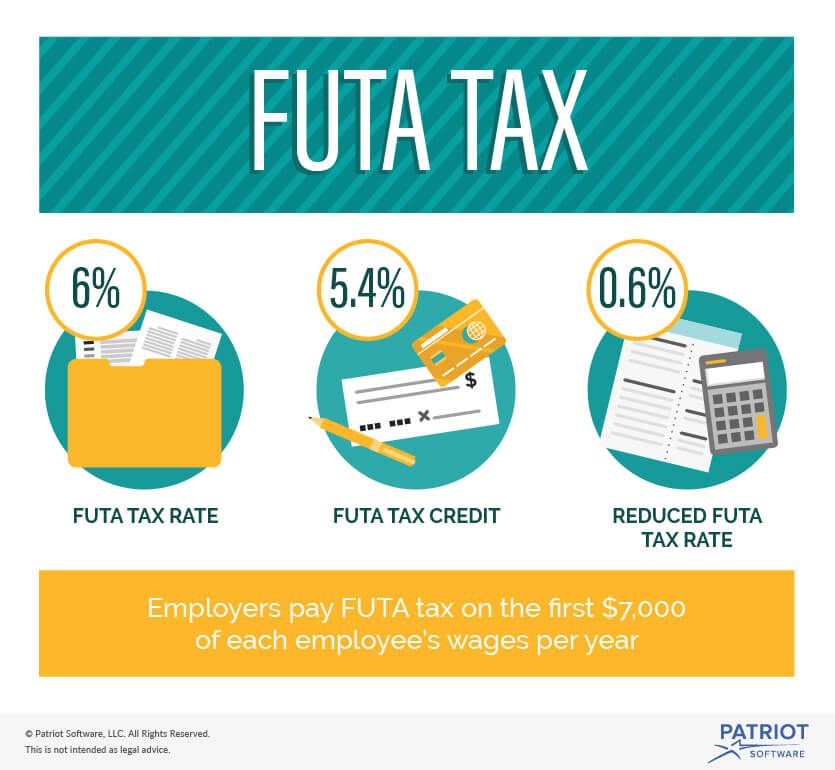

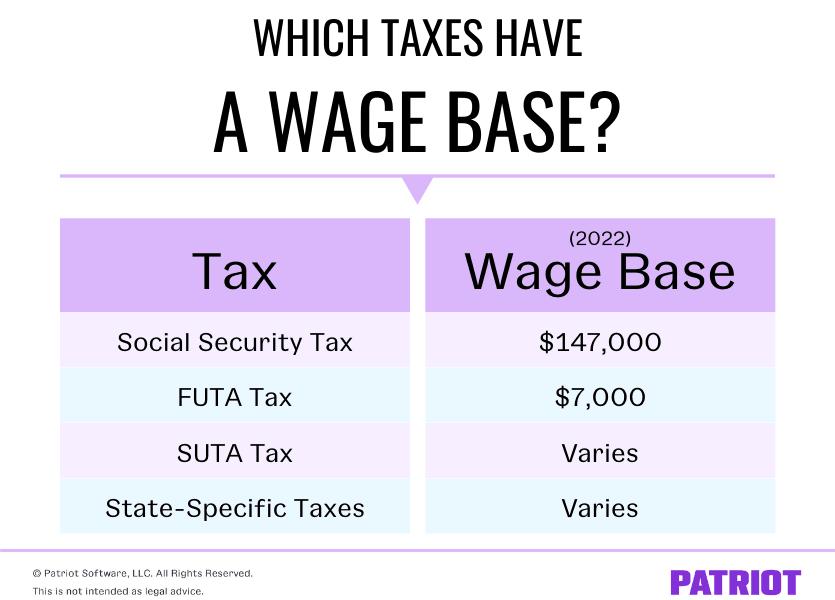

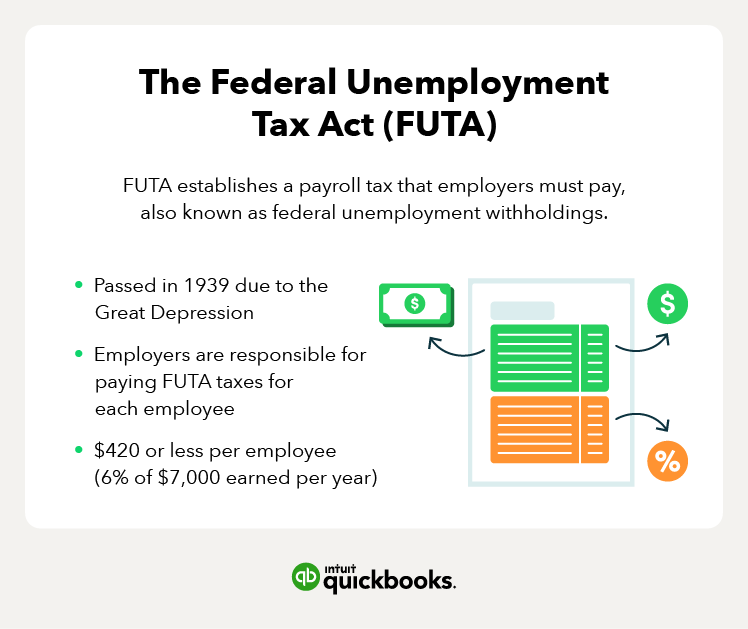

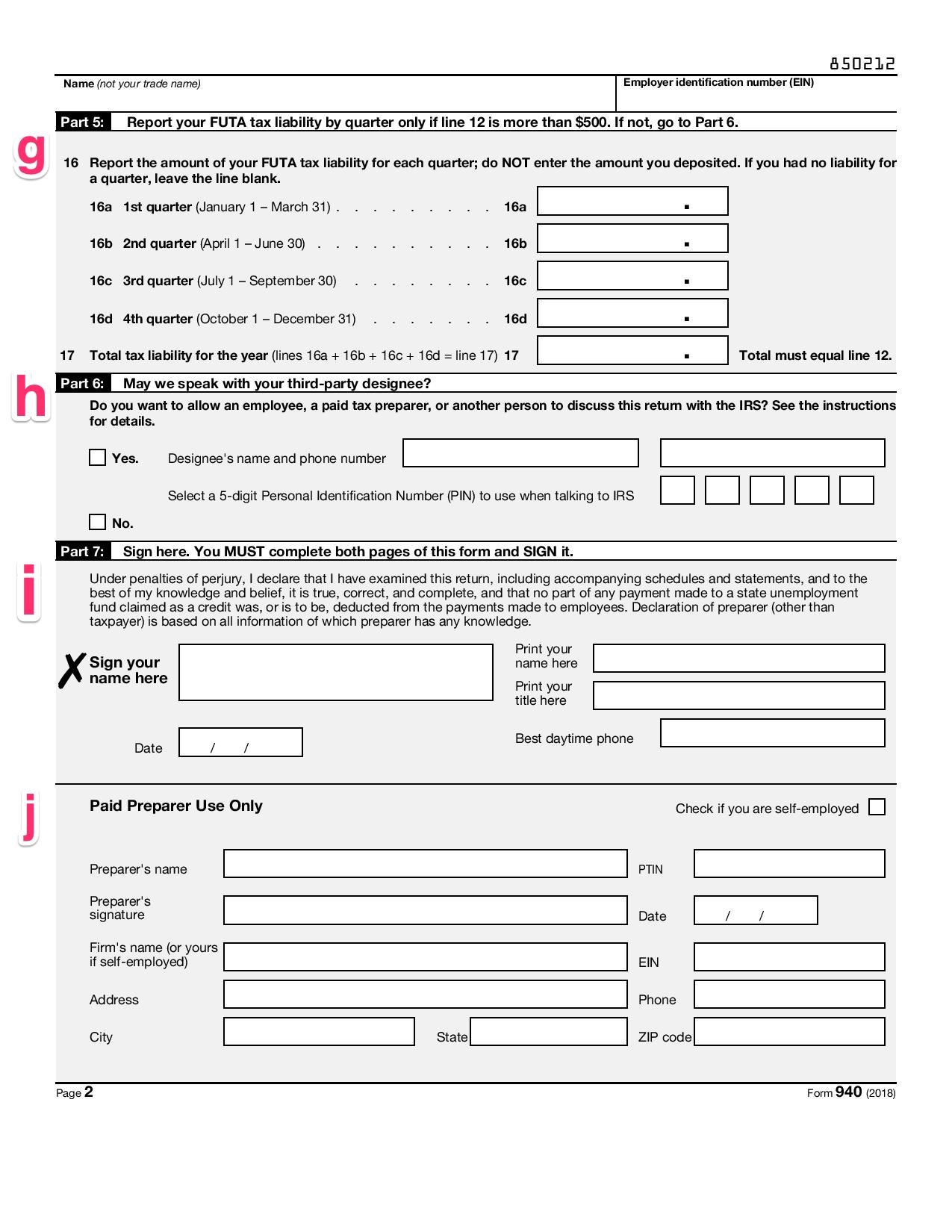

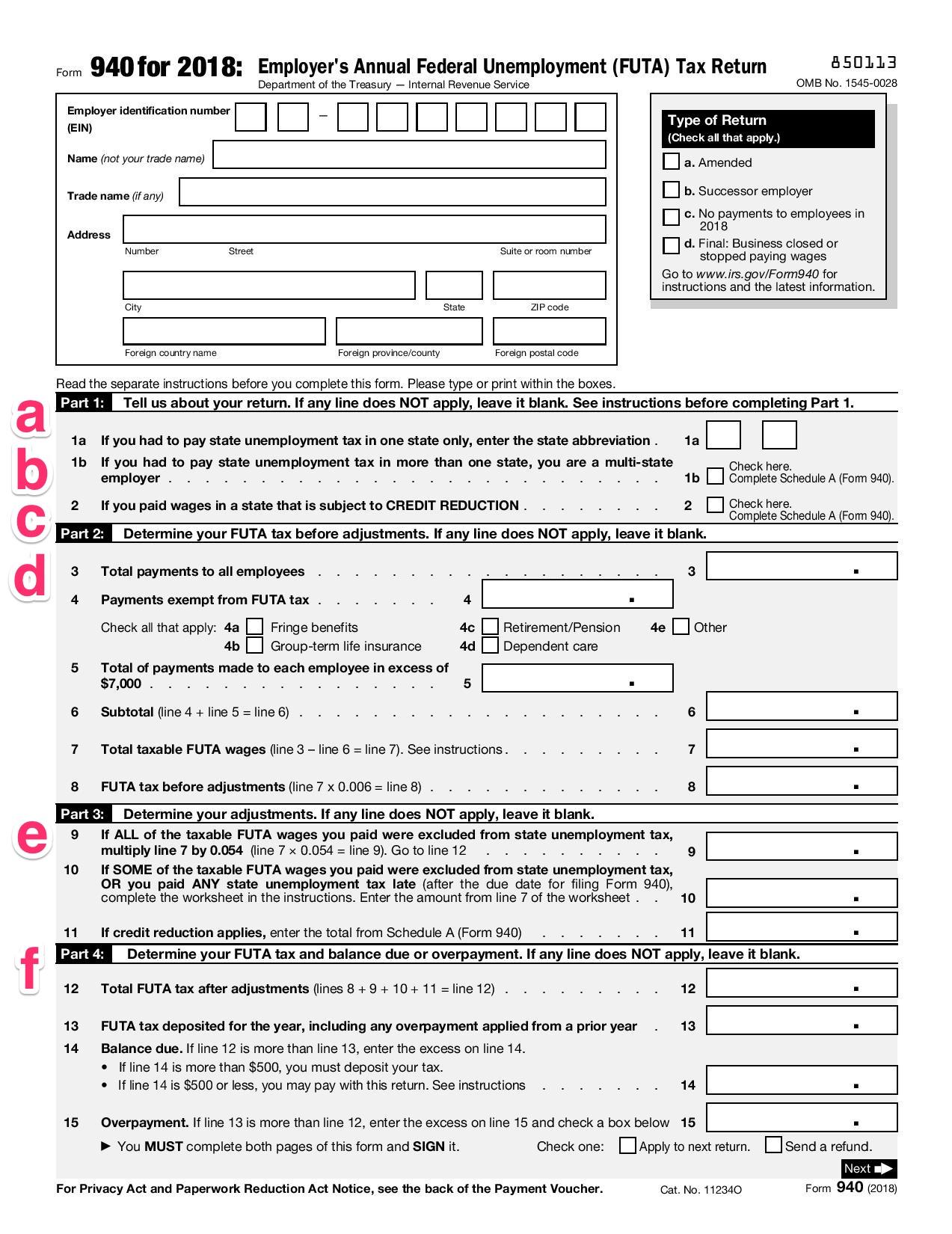

FUTA tax is filed using Form 940 the Employers Annual Federal Unemployment Tax Return. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. An employers tax rate determines how much the employer pays in state Unemployment Insurance taxes.

Form 940 is due each year on January 31. The first component of the tax rate is the experience-based tax which is based on the amount of unemployment benefits paid to. The 54 rate can be earned or it can be assigned to employers who have delinquencies greater than one year and to those employers who fail to produce all work records requested for an.

The rate is based on the ratio between the reserve-balance compared to the average annual taxable payroll for the last three completed fiscal years. The State Unemployment Tax Act commonly referred to as SUTA tax is a state unemployment insurance program requiring employers to pay towards a fund. The reserve ratio is the balance in an employers UI account premiums paid less benefits paid for all years liable divided by their average taxable payroll for the three most recent years.

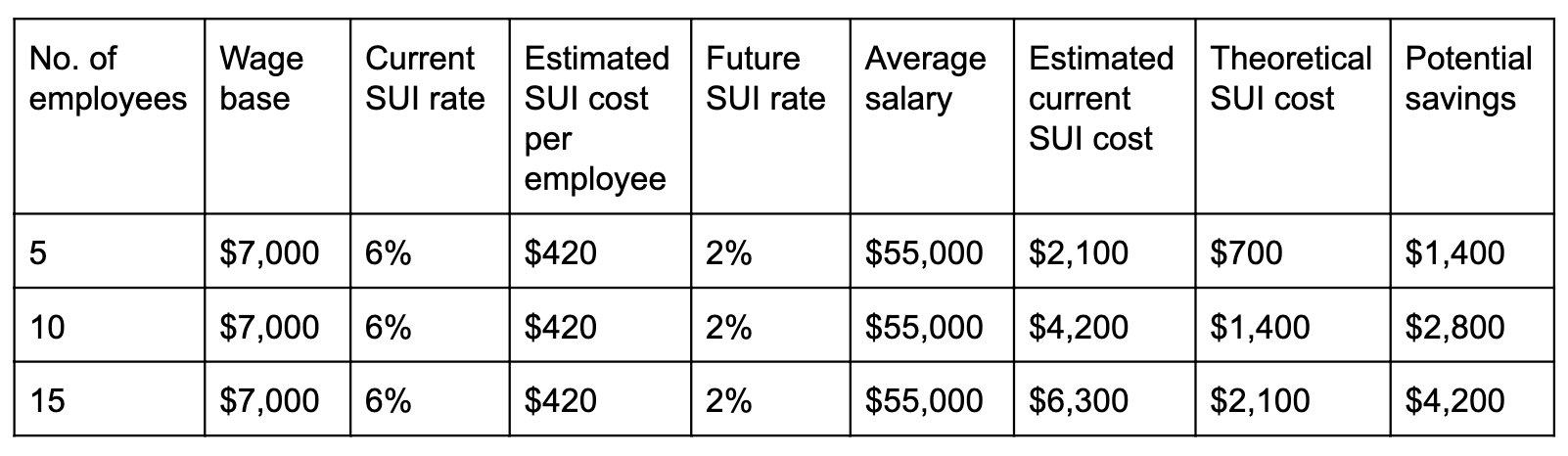

The states SUTA wage base is 7000 per. Your contribution rate can. The tax rate shown on the Unemployment Tax Rate Assignment Form becomes final unless protested in writing prior to May 1 of the following year.

This percentage is applied to taxable wages paid to determine the amount of employer contributions due. General employers are liable if they have had a quarterly payroll of 1500. Employers may make a voluntary.

California has four state payroll taxes. Lets say your business is in New York where. An employers SUTA rate is often referred to as a contribution rate.

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

Sui Definition And How To Keep Your Sui Rate Low Bench Accounting

How To Reduce Your Clients Suta Tax Rate In 2014

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

What S The Cost Of Unemployment Insurance To The Employer

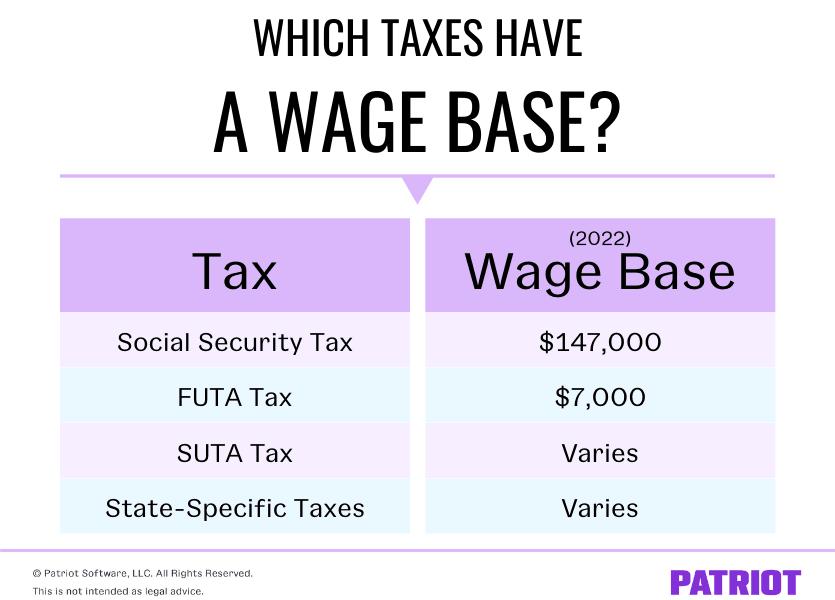

What Is A Wage Base Definition Taxes With Wage Bases More

Reducing Unemployment Insurance Costs Ui Suta

Futa Suta Unemployment Tax Rates Procare Support

State Unemployment Tax Act Suta Tax Rates 123paystubs Youtube

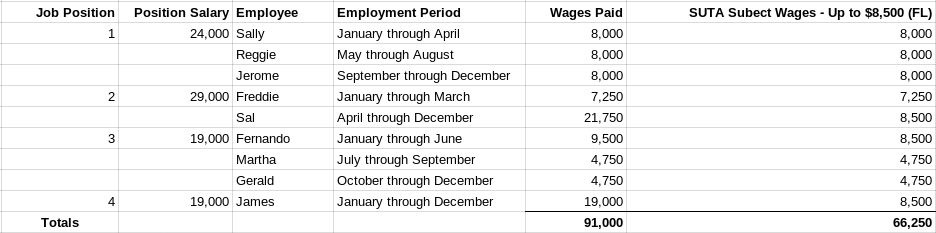

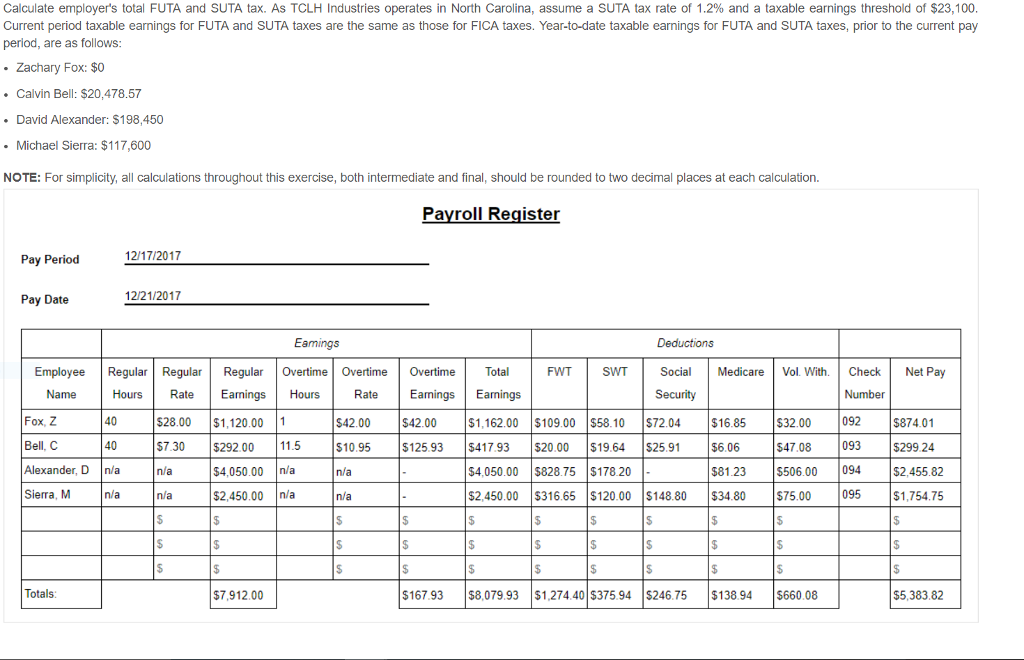

Calculate Employer S Total Futa And Suta Tax As Tclh Chegg Com

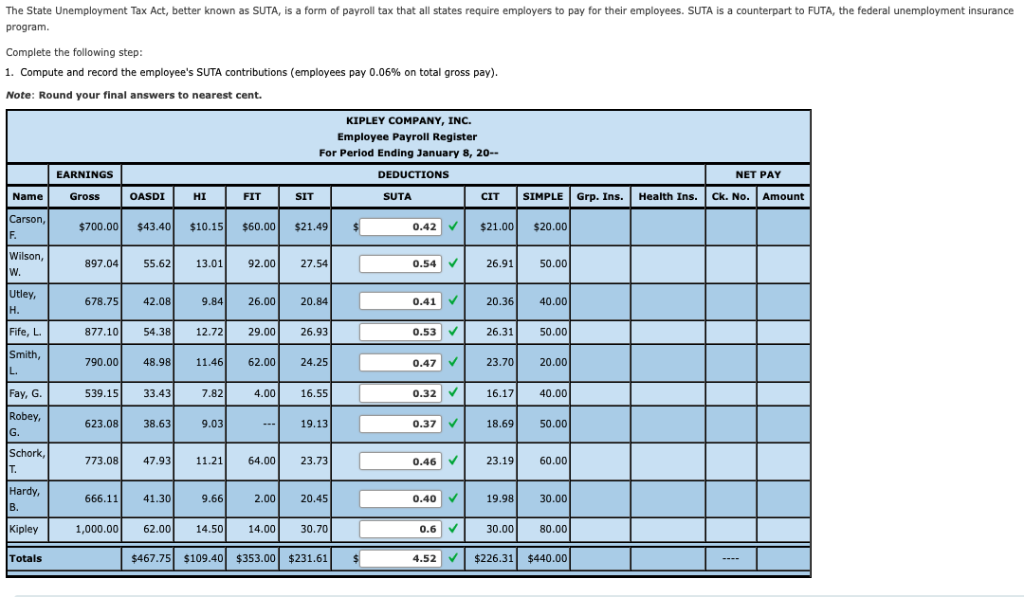

Solved The State Unemployment Tax Act Better Known As Suta Chegg Com

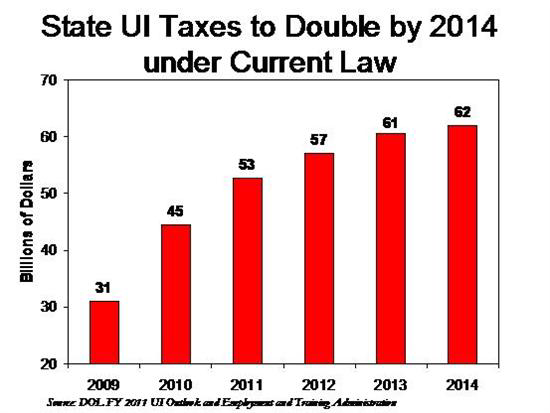

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19

Futa Tax Overview How It Works How To Calculate

What Is The Futa Tax 2022 Tax Rates And Info Onpay